One of the benefits of being a doctor is the Lenders Mortgage Insurance (LMI) waiver they can get even if they only have a 10% deposit. Currently, the major banks waiving LMI for medical professionals are CBA, NAB, Westpac, and ANZ.

For 2nd tier lenders, I have Bankwest, Suncorp, Macquarie, and St George.

Doctors are fortunate because they get these incentives that are unavailable to regular borrowers. This is because medical practitioners are considered low-risk borrowers. They’re highly in demand, highly trained, and highly paid as well.

So how much can a medical practitioner save when buying a property? Below is a matrix of the possible LMI savings depending on the value of the property and the size of the deposit. For a purchase price of $1 million and a 5% deposit of $50,000, a doctor can save between $38,285 to $41,340 depending on the bank.

If there is a joint application and only one of the applicants is a doctor and the other applicant is not, banks will still lend with the LMI waived.

It used to be that banks will only waive the LMI if the doctor has a 10% deposit. Today, three of the major lenders are willing to lend even up to 95% of the value of the property with the LMI waived.

A major requirement of the banks for doctors borrowing without LMI is their AHPRA registration. AHPRA stands for Australian Health Practitioner Regulation Agency. For proof of income, PAYG doctors need to provide their latest payslips, income statement and notice of assessment. If the doctor is self-employed, 2 years’ financial statements and tax returns are required and your ABN should be at least two years old. ANZ only requires an 18 month old ABN.

What is CBA’s Home Loans for Doctors?

CBA has this Medico Plus offering for medical professionals in which the bank will lend up to 95% of the value of the property so doctors only need to provide a 5% deposit without paying loan mortgage insurance. It is available on a Fixed or Variable Rate loan product with maximum lending of $3 million.

But even with the 95% no LMI medico policy for doctors, there are certain restrictions which applications need to meet such as LVR restrictions for certain postcodes and property types, whether the property is an acceptable or unacceptable security and the Debt to Income Ratio not greater than 6. CBA’s medico policy excludes physiotherapists, psychologists and nurses.

- Anaesthetist

- Cardiothoracic surgeon

- Clinical pharmacologist

- Cosmetic surgeon

- Dentist

- Dermatologist

- Ear and Throat Surgeon

- Emergency surgeon

- Endicronologist

Pharmacists are accepted. They need a minimum annual income of $150,000.

What is ANZ’s Home Loans for Doctors?

If you are an eligible medical professional and apply for a loan with a loan to value ratio of 95%, ANZ will waive the premium on LMI. The great thing about ANZ is that there is no minimum income requirement. You only need to have at least 5% of the property’s value plus stamp duty and the bank will lend up to 95% of the value of the property.

This loan is available to a medical practitioner, specialist or dentist registered with the Australian Health Practitioner Regulation Agency (AHPRA). You have to be an Australian citizen or a permanent resident. For doctors on the 457 or 482 visa, the occupation code should be listed on the Medium and Long Term Strategic Skills. To get a loan, the doctor should have an equal or majority share in the property.

The maximum loan that a doctor can get is $4.75 million for a purchase price of $5 million if purchasing a house or a townhouse. If you are purchasing a unit, the maximum loan is $3.8 million for a $4 million purchase price. For a doctor to borrow with just a 5% deposit, the 5% has to be genuinely saved and the borrower must have an existing ANZ credit facility i.e. a credit card or a personal loan in the last 6 months. If not, then you can still borrow but only up to 90% of the purchase price, which means your deposit should be 10% of the value of the property. Investment lending requires a deposit of 10% or a 90% loan to value ratio.

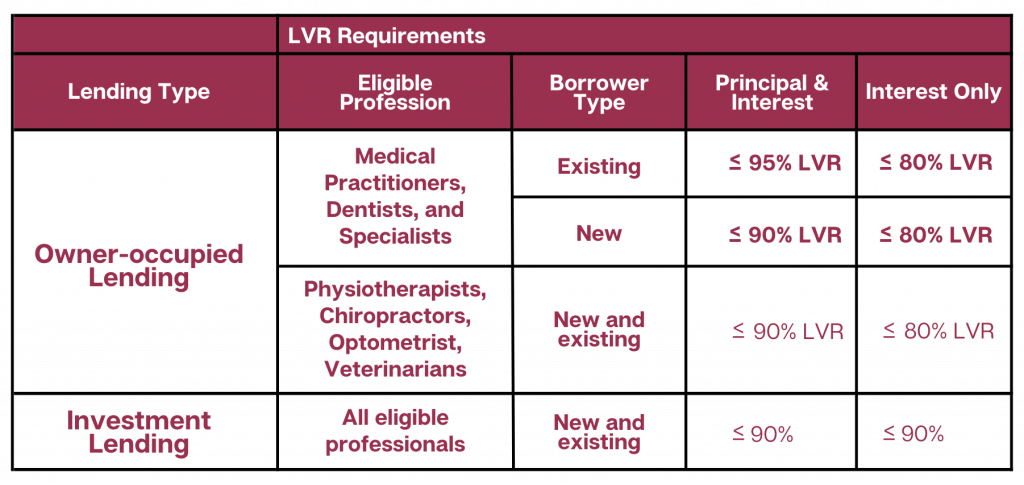

Medical practitioners, dentists and specialists can borrow up to 95% of the property’s value. Physiotherapists , chiropractors, optometrists and veterinarians can borrow up to 90% of the value of the property. Refer to the matrix below.

Loan To Value Ratio (LVR)

The LVR thresholds of the MCR apply and are unchanged by this Medical Professional Package.

What are Westpac’s Home Loans for Doctors?

Westpac’s medico policy is available for both owner-occupier and investment loans.

The list of eligible medical professionals includes the following:

- Dentists

- Doctors

- Hospital-employed doctors (e.g. intern, resident)

- Optometrists

- Pharmacists

- Veterinarians

This list has been extended recently and includes the following professions. There is a minimum taxable income of $90,000 for these occupations.

- Audiologists

- Occupational therapist

- Osteopath

- Podiatrist

- Psychologist

- Radiographer

- Sonographer

- Speech pathologist

What are the requirements of Westpac?

- Most recent Australian tax return

- A copy of Australian university degree or qualification

- Copy of registration with the Medical Practitioners Board of Australia or equivalent body

The maximum loan amount with Westpac is $5 million. If you’re PAYG, you need to provide your latest payslips and your income statement. If you’re self-employed, you need to provide your personal tax returns and notice of assessment.

Where a doctor obtained their qualifications in another country, are they eligible for the Medico policy?

Applicant must currently be registered to practice with either the Australian Medical Council (AMC), or the Australian Dental Council (ADC), and must provide a copy of current registration with the Medical / Dental / Veterinary Practitioners Board of Australia or equivalent body in the State or Territory in which they practice.

What is NAB’s Home Loan for Doctors?

NAB’s medico policy can lend up to 95% loan to value ratio with LMI waived. It is available to medical practitioners such as

- Anesthetist,

- Dermatologist

- General Practitioners (GP)

- Obstetrician

- Gynaecologist

- Ophthalmologist

- Paediatrician

- Physician

- Pathologist

- Psychiatrist,

- Radiation oncology,

- Radiologist

- Surgeon

- Dental practitioners

- Optometrist

- Veterinary practitioners

- Pharmacists (New addition)

To prove that you are an eligible medical/dental practitioner or optometrist, you need to provide your registration status with the Australian Health Practitioner Regulation Agency.

This loan is available for individual supporting residential security up to $4.5 million regardless of location.

NAB recently increased the LVR to 95% for the LMI waiver for medical professionals. This used to be 90%. This only applied to owner-occupied loans. For investment interest-only loans, the maximum LVR is still 90% with the LMI waived. Restrictions for high-risk post codes still apply. Pharmacists have also been added to the list of eligible medical practitioners.