There is hope for first-home buyers in New South Wales. NSW Premier Dominic Perrottet has announced that first-home buyers purchasing properties for up to $1.5 million can choose to pay an annual property tax instead of paying the full stamp duty upfront, this is called First Home Buyer Choice.

The scheme aims to reduce the cost of buying a first home by removing stamp duty expense, which is substantial. Under the new program, you can choose to instead pay an annual tax of $400 plus 0.3% of the land value (not the purchase price).

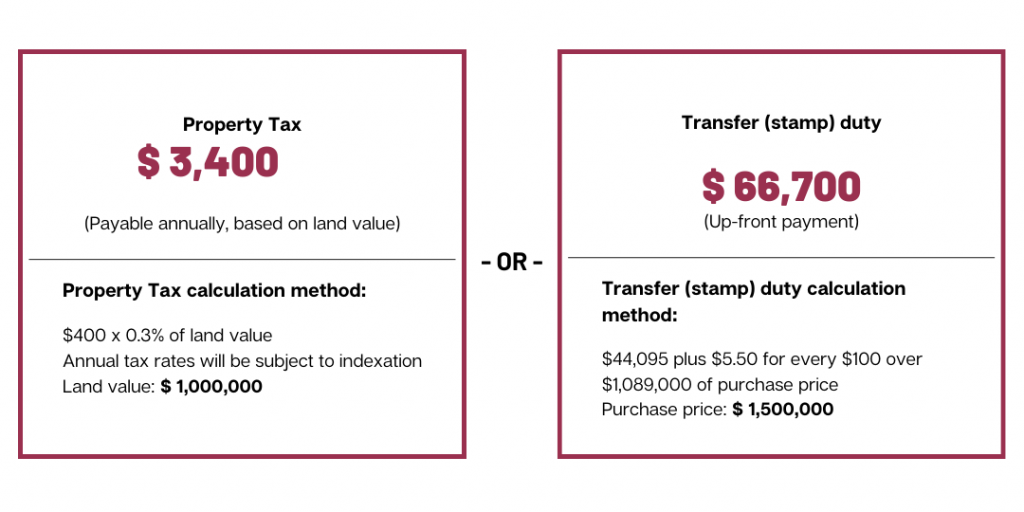

Example 1:

Purchase price: $1,500,000

Land value: $1,000,000

A first-home buyer purchasing a $1.5 million property will need to pay $66,700 in stamp duty upfront. With this initiative, if the land value is $1,000,000, the annual tax is $3,400.

A First Home Buyer Choice calculator can be found here.

If you choose to pay:

Example 2:

Purchase price: $1,000,000

Land value: $600,000

A first-home buyer purchasing a $1 million property will need to pay $40,090 in stamp duty upfront. With this initiative, if the land value is $600,000, the annual tax is $2,200.

A First Home Buyer Choice calculator can be found here.

If you choose to pay:

The First Home Buyer Choice scheme begins on the 16th of January 2023, However, if you’re a first home buyer and you make a purchase when the legislation is enacted until January 15 of next year, you can apply for a refund on your stamp duty and choose to pay the annual tax. An online property tax calculator will be made available after the passage of legislation and before the 16th of January.

You can find further FAQs about the First Home Buyer Choice here.

Right now, only first-home buyers in NSW are eligible for the First Home Buyer Choice. You must be an Australian citizen or a permanent resident and you and your partner have not owned a house in the past.

Eligible properties include a house, townhouse, strata unit, company title unit, flat, duplex or a vacant block of residential land intended as the site of a first home.

What if you purchase a property for $650,000 or less?

Example 3:

Purchase price: $650,000

A first-home buyer purchasing a $650,000 property is fully exempt from paying stamp duty.

In this scenario, it makes sense not to opt for the annual tax.

What if you purchase a property for more than $650,000 and less than $800,000?

There is a stamp duty concession for purchases between $650,001 to $800,000.

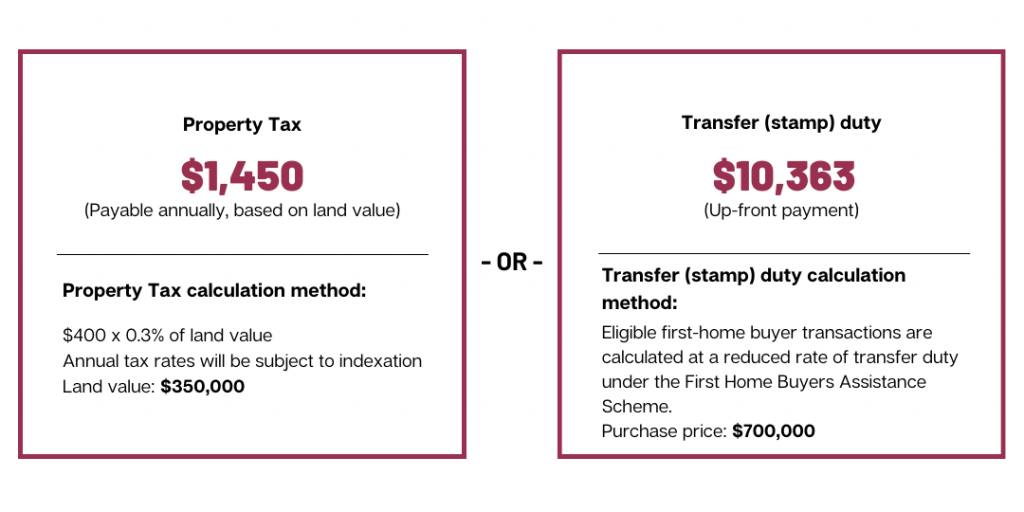

Example 4:

Purchase price: $700,000

A first-home buyer purchasing a $700,000 property pays a stamp duty of $10,363.33 and saves $16,226.67 in stamp duty cost. If the first home buyer opts for the annual tax and the value of the land for a $700,000 purchase is $350,000, the annual tax payment is $1,450. If the first home buyer plans to live in the property for more than 7 years, then it makes sense for the FHB to pay the reduced stamp duty upfront.

If you choose to pay:

Can you use the First Home Buyer Choice in combination with the Home Guarantee Scheme?

Yes, you can. Using all the grants and schemes available to you as first home buyers will help you get into the property market quickly. Let’s look at the scenario below.

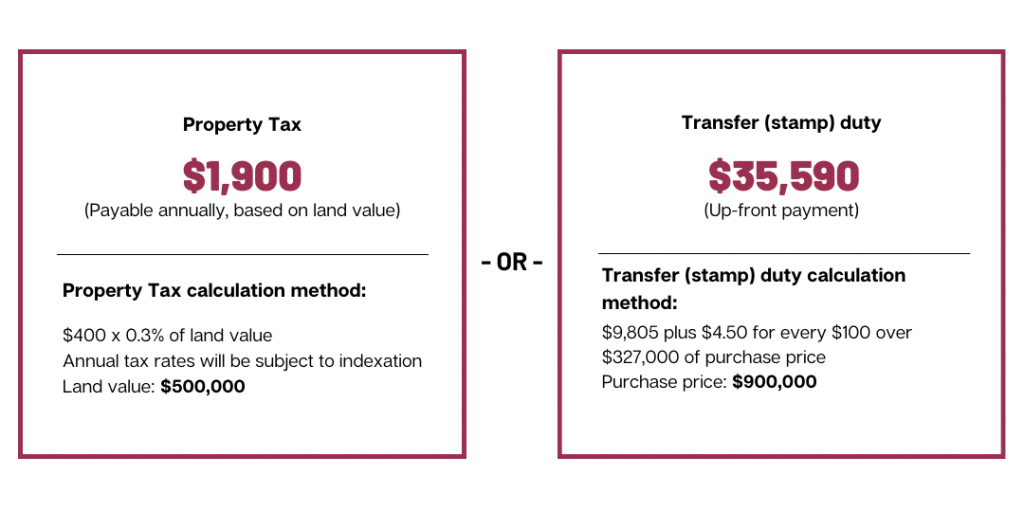

John and Susan are first home buyers purchasing a $900,000 townhouse in Pemulwuy. They are both Australian citizens and have never owned a house before. Their combined income is below $200,000 as evident from their Notice of Assessment from 2021-2022. The $900,000 purchase price is within the price cap of the Home Guarantee Scheme.

If John and Susan will qualify for the Home Guarantee Scheme, they only need a 5% deposit and borrow up to 95% of the purchase price (subject to the bank lending them the money). Full stamp duty for a $900,000 purchase price is $35,590. If John and Susan qualify for the First Home Buyer Choice, they can opt for the annual tax. Let’s say the land value is $500,000 for the $900,000 purchase price of a house. The annual tax is $1,900.

If you choose to pay:

In this scenario, John and Susan only need to come up with the following savings for a deposit.

5% deposit of $45,000

Stamp duty $1,900 (based on annual tax)

Currently, they need $80,590 to purchase a $900,000 property in NSW.

Helping first-home buyers get into the property market and purchase their dream home is what we do best. If you want to find out about the various schemes and grants available to you as a first home buyer, give us a call at 0430 144 008 or email us at mpapa@maverickfinance.com.au.

Maria Papa is a senior property and finance expert specialising in home loans, investment loans, self-employed loans, alt doc loans, car loans, personal loans, and loan protection. She has offices in Sydney, Melbourne, and Manila.

Your full financial situation will need to be reviewed prior to acceptance of any offer or product.