For the second month in a row, the Reserve Bank of Australia (RBA) has increased the official cash rate, this time by a further 50 basis points to 0.85 per cent, as it tries to curb inflation.

Most people were asking ‘how high’ not ‘if’ the RBA would increase the cash rate this month, so the decision is no surprise. The 0.5 percentage point jump is the largest one-month lift since the RBA pushed up rates by half a percentage point in early 2000.

Why did the RBA increase the cash rate and what does it mean?

The RBA generally increases interest rates when inflation reaches a certain point (the goal is to keep it between 2-3 per cent). Inflation is the main measure of cost of living, or how much our money is worth, and it’s taken off in Australia.

The latest inflation data showed Australia had recorded the highest quarterly and annual increase in more than two decades.

By increasing the cash rate, it appears that the RBA is trying to slow down demand in the economy and discourage people from spending money. Bigger repayments can mean less money to splash around elsewhere.

What’s the impact on homeowners?

Once the RBA raises the cash rate, lenders often pass this on to borrowers via an increase in their variable interest rates. Some lenders have already begun passing on the rate increase in full.

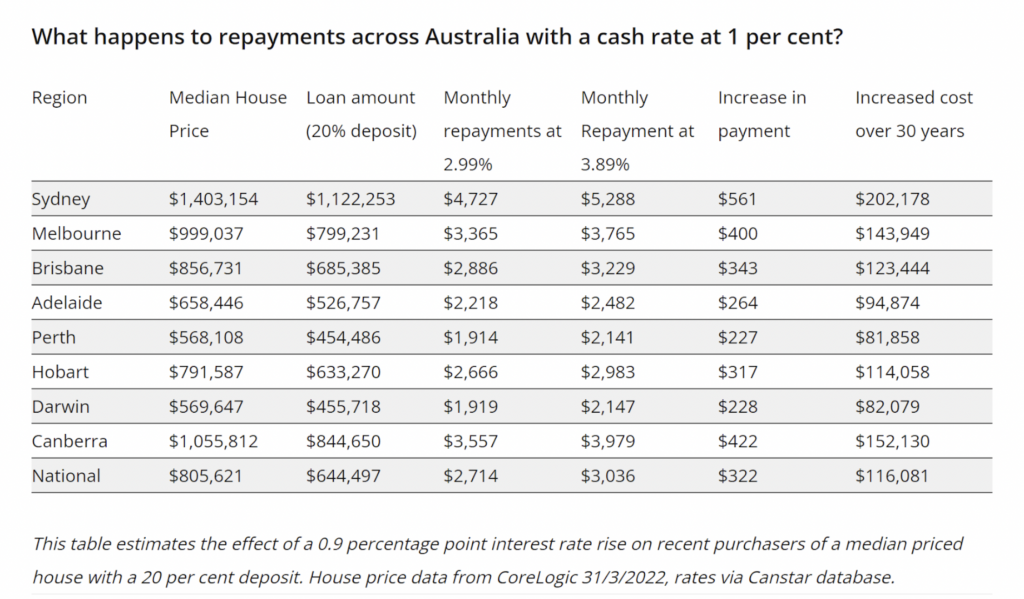

Even a small increase in your variable interest rate could have an impact on your repayments.

As an example, say you are a homeowner with a $500,000 mortgage. Your monthly repayments at 2.99% is $1,976. With the .50% rate increase, your rate will go up to 3.49% and your repayment will be $2,108.

Those on a fixed-rate loan will be temporarily shielded from the cash rate increase until their fixed rate period ends.

There could also be other flow-on effects for homeowners from the cash rate increase, including further downwards pressure on housing growth rates, which were already losing momentum.

Are further cash rate increases expected?

This appears likely. Reserve Bank governor Philip Lowe said the Board was committed to doing what was necessary to ensure that inflation in Australia returned to target over time.

“This will require a further lift in interest rates over the period ahead,” he said.

Lowe indicated it was not unreasonable for the cash rate to climb to 2.5 per cent.

What do I do if I can’t make my repayments?

With interest rates likely to continue going up, it’s important not to be complacent. Now is the time to review your home loan to make sure it still meets your requirements.

We can review your home loan, explain whether your lender is passing on the cash rate increase and how this will impact your repayments.

If you think you may have difficulty meeting your repayments, here are some options to consider:

- request a lower interest rate

- temporarily switching to interest-only repayments

- fixing your interest rate may help you budget for repayments

- asking for fees and charges to be waived

- consolidate debts to make repayments more manageable.

We’re available to discuss these options, so please don’t hesitate to get in touch today.

Meanwhile, there have been other changes recently that could affect new borrowers. Some lenders have cut their debt-to-income (DTI) ratio limits, thereby tightening home lending rules amid expectations of more interest rate rises.

If you’re in the market, speak to us about how these changes could affect you or watch the video below.

https://youtu.be/tnMAiaCB8U4